how likely will capital gains tax change in 2021

Your 2021 Tax Bracket to See Whats Been Adjusted. Although it is now clear Capital Gains Tax CGT and Inheritance Tax IHT rates and allowances have avoided changes in 2021 they are still very possible for the budget in 2022 or in future years.

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year.

. Capital Gains Tax Changes We Expect To See In 2021. Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. While the way capital gains taxes are treated may change in 2021 those who had previously been in either the 0 or 15 categories will likely see no change.

One of the areas the government is looking to increase its tax collection from is capital gains. Gains from the sale of capital assets that you held for at least one year which are considered. CAPITAL GAINS TAX is likely to increase and there could be major implications for some Britons an expert has warned ahead of the Chancellor Rishi Sunaks Budget.

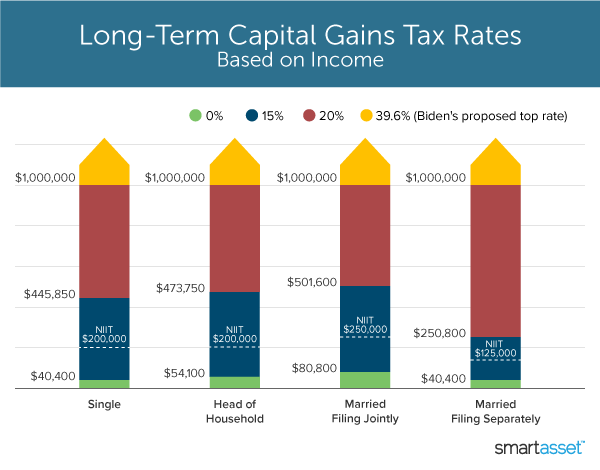

Long-term capital gains are taxed at either 0 15 or 20 depending on your tax bracket. The bank said razor-thin majorities in the House and Senate would make a big increase difficult. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

21st December 2020 News Tax. By Rebekah Evans 0400 Sun. Ad Compare Your 2022 Tax Bracket vs.

The Budget is fast approaching on 3 March 2021 and there is speculation that the rates of Capital Gains Tax CGT a tax on the difference between an assets value at acquisition and its value at disposal could be increased. Another would raise the capital gains tax rate to 396 percent for taxpayers earning 1 million or more. Such speculation has been fuelled by the chancellors request in July 2020 for the Office of Tax Simplification.

May 11 2021 800 AM EDT. Under the current proposal gains realized prior to Sept. Biden is proposing that Congress raise the top tax rate on capital gains from 20 to 396.

The changes will be effective from the date of the Budget 3 March 2021. The new top rate combined with an existing 38 surtax on investment income over certain thresholds. President Joe Biden is expected to propose raising the top federal capital gains tax to 396 from the current 20 for millionaires.

Most of the proposals limit the higher. Capital Gains Tax Rate Threshold 2021 Capital Gains Tax Rate Threshold 2020 0. Entrepreneurs relief was slashed last April so that instead of being charged 10 on the first 10m of gains anything above 1m would be taxed at the usual 20.

This is called entrepreneurs relief. Capital Gains Tax Rate Threshold 2021 Capital Gains Tax Rate Threshold 2020 0. Capital Gains Tax Rate Threshold 2021 Capital Gains Tax Rate Threshold 2020 0.

Taxpayers subject to the net investment income tax pay another 38 currently and would continue to pay that after any of the proposed increases are enacted. Long-term capital gains taxes are assessed if you sell investments at a profit after owning them for more than a year. Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021.

Capital gains tax is likely to rise to near 28 rather than 396 as Joe Biden plans Goldman said. President Joe Biden recently announced his individual tax proposals which include a 396 long-term capital gains tax rate the elimination of the stepped-up basis on. But because the higher tax rate as proposed would only.

More from Your Money Your Future. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently. These changes may be significant and have large ramifications for your investments.

If you realize long-term capital gains from the sale of collectibles such as precious metals coins or art they are taxed at a maximum rate of 28. At this point many ideas are being considered as legislators look for ways to raise revenue to help pay for the Build Back. 13 will be taxed at top rate of 20.

Still another proposal would make the change to capital gains tax retroactive with a start date of April 2021. Those tax rates for long-term capital gains are typically much lower than the ordinary tax rates youd otherwise pay which can be as high as 37. Chancellor Rishi Sunak spent billions to protect the country and ensure that.

If a change is announced in the Budget when will the capital gains tax rates go up. Based on the way the government has introduced tax changes in the past there are two likely possibilities. Ad Compare Your 2022 Tax Bracket vs.

Long-term gains still get taxed at rates of 0 15 or 20 depending on the. 4 rows The proposal would increase the maximum stated capital gain rate from 20 to 25. When the Coronavirus had a stranglehold over the UK back in March emergency economic measures were put in place such as the furlough scheme to protect businesses and individuals alike.

Discover Helpful Information and Resources on Taxes From AARP. Gains realized after that date would be taxed at a. SEE MORE IRS Releases Income Tax Brackets for 2021.

Capital Gains Taxes on Collectibles.

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

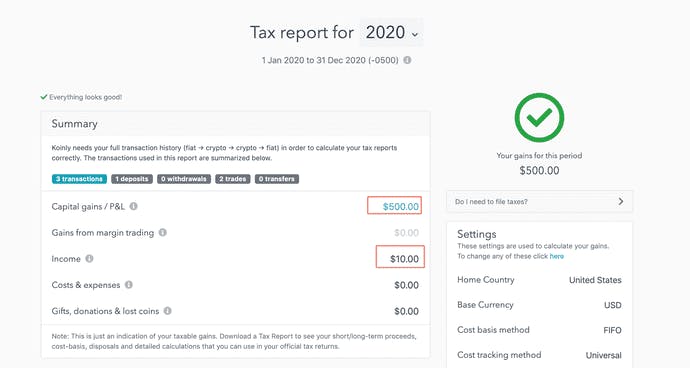

Germany Crypto Tax Guide 2022 Koinly

Capital Gains Tax Advice News Features Tips Kiplinger

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How To Avoid Capital Gains Tax On Rental Property In 2022

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2022 And 2021 Capital Gains Tax Rates Smartasset

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Made A Profit Selling Your Home Here S How To Avoid A Tax Bomb

Difference Between Income Tax And Capital Gains Tax Difference Between

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)